The major stock market indexes have absolutely skyrocketed in the past few years. Why? Here is what I think.

Estimated Market Returns

My estimated annual market returns by region:

- 5.6% - United States

- 8.3% - Asia

- 3.6% - Europe

I calculate the above numbers by adding the inverse of the P/E ratio of the general market to the expected GDP growth of the area. I estimate the GDP growth by looking at the chart and averaging the last few years, or looking at historical growth fluctuation and estimating it's recurrence. The United States P/E ratio is derived from the P/E ratio of the S&P 500 index. The Asia P/E ratio is derived from the P/E ratio of the MSCI AC Asia Total Market Index. The Europe P/E ratio is derived from the P/E ratio of the STOXX® Europe Total Market Index.

Why do people keep piling money into the market if the returns are lower than avg.?

Simple - even though the market is giving less than avg. returns, these returns are still greater than other investment vehicles, mainly government issued bonds. Therefore, the stock market is still a better option. Until the FED hikes up the rates on short-term and long-term T-bonds, we should not expect anything more than a healthy correction out of the market.

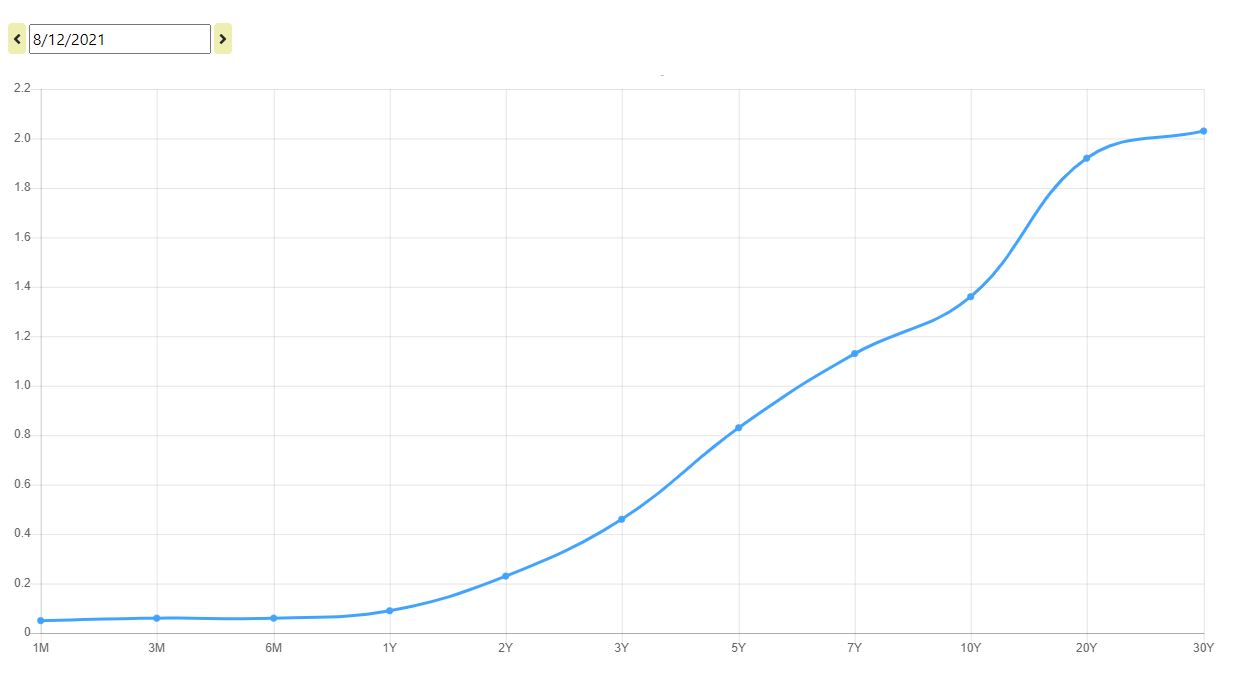

Have a look at this yield curve of U.S. Treasuries from 2021:

No bond beats the returns of the U.S. stock market's estimated returns. That is why the "economy" is booming (or at least the stock market is booming). The reason why the rates are so low is because a) the FED wants to stimulate the economy and/or b) the government has so much debt that they cannot afford to lend to private borrowers at higher rates. This is why they are printing so much money: to spend it...

Extra Cash

This is not even to mention inflation and stimulus checks giving people extra money to invest. You see that gif I put as the image for this post? That's kind of what the Federal Reserve is doing right now. Money printer go brr.

With the amount that the money supply has skyrocketed up, it is only a matter of time until the tolls of inflation begin to manifest themselves in the prices of goods and lost purchasing power (or we will only see an asset-fixated bubble form, such as in the stock market). When prices increase, companies make more (in terms of numbers, not value). When companies make "more" money, their shares are worth more (again, in terms of numbers, not value). This is why you must offset market returns with inflation. This is also why I say that the stock market is one of the best hedges against inflation; Despite the fact that you are exposed to the currency that is inflating, you are riding the wave of nominally increased profits from the entities you own equity in.

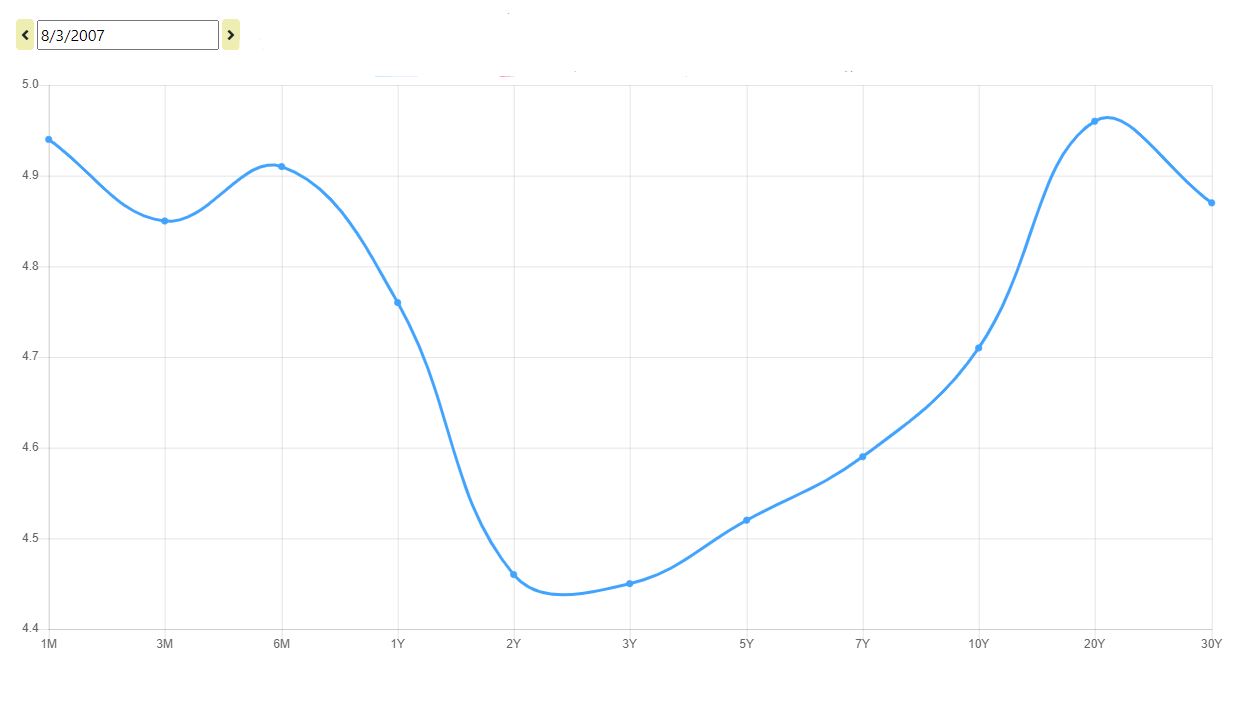

The huge bull run in the stock market and the huge amount of money being printed in the U.S. at the same time was not a coincidence, and companies are not doing that much better (especially with the velocity of money at such a downturn with COVID shutting everyone down). In the event that the FED sees this starting to happen, they may want to slow the economy down by increasing the rates on auctioned Treasuries. Take a look at the U.S. Treasuries yield curve just a month before the major crash of 2008:

In fact, if you look back at many major stock market crashes, they are usually after this yield curve chart starts looking like a 'U' and/or rates skyrocket.

You should really just have a look at the chart for the M1 money supply. M1 is a narrow measure of the money supply that includes physical currency, demand deposits, traveler’s checks, and other checkable deposits. We can look at the following chart and find an almost perfect correlation to recent stock market moves. The bull run in the market that started after the 2008 crash coincided with an increase in the growth rate of the M1 money supply. In 2020, even though the economy has been stalled, the M1 money supply has been increased beyond belief, and so has the stock market. It is debatable whether or not the money supply is to blame for this extreme stock market pump and/or inflation, so read the data as you wish. However, it seems that the market just continues to go up, which leads me to believe that all the money that has been printed recently still has not made it's way into the market completely yet, and more of it is still to be added in as time goes on.

Back to Blog

Back to Blog